Beginning with How to Bundle Home and Auto Insurance to Save More, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Exploring the nuances of bundling home and auto insurance can lead to substantial cost savings and a more comprehensive coverage plan.

Understanding Home and Auto Insurance Bundling

When it comes to insurance, bundling home and auto insurance is a common practice where you purchase both types of insurance from the same provider. This means having your home and car insurance policies under one insurance company.Bundling home and auto insurance offers several benefits to policyholders.

One of the main advantages is the convenience of dealing with a single insurance provider for both policies. This can streamline the process of managing your insurance policies, making it easier to keep track of payments, renewals, and claims.Cost savings are another significant advantage of bundling home and auto insurance.

Insurance companies often offer discounts to customers who bundle multiple policies with them. By combining your home and auto insurance, you may be eligible for a discount on your premiums, ultimately resulting in savings on your overall insurance costs.

How Bundling Can Result in Cost Savings

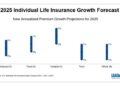

When you bundle your home and auto insurance policies with the same provider, you may qualify for a multi-policy discount. This discount can vary depending on the insurance company but typically ranges from 5% to 25%.In addition to the multi-policy discount, insurance companies may also offer other incentives to policyholders who choose to bundle.

These incentives could include loyalty rewards, accident forgiveness, or even lower deductibles.By taking advantage of these discounts and incentives through bundling, you can potentially save hundreds of dollars each year on your insurance premiums while still maintaining the coverage you need for your home and vehicles.

Factors to Consider When Bundling Home and Auto Insurance

When bundling home and auto insurance, several factors come into play that can influence the cost savings and overall benefits for policyholders. Understanding these factors is crucial in making informed decisions when selecting bundled insurance options.

Location of the Insured Property

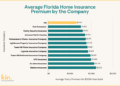

The location of the insured property is a key factor that can affect the cost savings when bundling home and auto insurance. Urban areas or regions prone to natural disasters may have higher insurance premiums due to increased risks of theft, vandalism, or weather-related damages.

On the other hand, rural areas with lower crime rates and less traffic congestion may offer lower insurance rates. It is essential for policyholders to consider the location of their property and how it impacts their bundled insurance rates.

Policyholder’s Driving Record

Another significant factor that can impact bundled insurance rates is the policyholder's driving record. Individuals with a history of accidents, traffic violations, or DUI convictions may face higher auto insurance premiums, which can affect the overall cost savings when bundling with home insurance.

On the contrary, policyholders with clean driving records and a history of safe driving habits are likely to qualify for discounts and lower rates. It is important for policyholders to maintain a good driving record to maximize savings when bundling home and auto insurance.

Tips for Maximizing Savings through Bundling

When bundling home and auto insurance, there are several strategies you can use to maximize your savings and get the best possible deal. It's essential to be proactive in negotiating better rates, reviewing coverage limits, and taking advantage of discounts offered by insurers.

Strategies for Negotiating Better Rates

- Bundle multiple policies with the same insurer to qualify for a multi-policy discount.

- Ask your insurer about available discounts for loyalty, good driving records, or safety features in your home.

- Consider raising your deductibles to lower your premiums, but make sure you can afford the out-of-pocket costs in case of a claim.

Importance of Reviewing Coverage Limits

When bundling home and auto insurance, it's crucial to review your coverage limits to ensure you have adequate protection for your assets. Make sure you understand the limits of your policies and consider increasing them if needed to avoid gaps in coverage.

Examples of Discounts Insurers May Offer

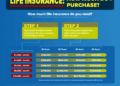

- Multi-policy discount: Save money by bundling your home and auto insurance with the same company.

- Claims-free discount: Insurers may offer discounts if you have not filed any claims in a certain period.

- Safety discounts: Installing security systems in your home or having a safe driving record can qualify you for additional savings.

Common Mistakes to Avoid When Bundling Insurance

When bundling home and auto insurance, it's crucial to be aware of common mistakes that could potentially cost you more money in the long run. By understanding these pitfalls, you can make informed decisions and maximize your savings. One of the key aspects to consider is the necessity of comparing quotes from different insurers to ensure you are getting the best deal possible.

Failing to do so may result in missing out on significant savings and better coverage options.

Importance of Comparing Quotes

Before bundling your home and auto insurance policies, it's essential to obtain quotes from multiple insurance providers. Each insurer has different rates and discounts available, so comparing quotes allows you to identify the most cost-effective option. By solely relying on one insurer, you may be missing out on better coverage at a lower price.

Implications of Underinsuring or Overinsuring

Another common mistake to avoid when bundling insurance is underinsuring or overinsuring your policies. Underinsuring can leave you financially vulnerable in the event of a claim, as you may not have adequate coverage to cover the full extent of the damage or loss.

On the other hand, overinsuring can lead to unnecessarily high premiums, resulting in wasted money that could have been saved or spent elsewhere. It's important to strike a balance and ensure you have the right amount of coverage for your specific needs.

Concluding Remarks

In conclusion, bundling home and auto insurance is a smart financial move that not only saves money but also streamlines your insurance needs. By combining these policies, you can enjoy convenience, potential discounts, and peace of mind knowing you're adequately covered.

Detailed FAQs

What are the benefits of bundling home and auto insurance?

Bundling can lead to discounts, simplified management, and potentially better coverage options.

How can policyholders negotiate better rates when bundling?

Policyholders can leverage loyalty discounts, inquire about additional discounts, and compare quotes from different insurers.

What factors influence the cost savings when bundling?

Factors like the insured property's location, driving record, and coverage limits can impact the cost savings when bundling.