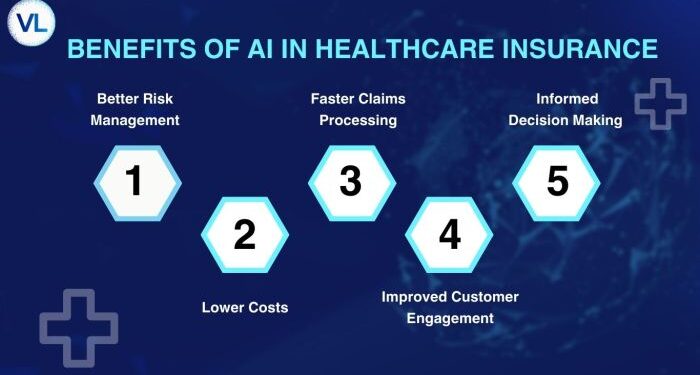

The Role of AI in Modernizing Health Insurance delves into the transformative impact of artificial intelligence in revolutionizing the health insurance sector. From enhancing customer experiences to fraud detection and prevention, AI plays a crucial role in modernizing the industry.

The Impact of AI on Health Insurance

AI has been transforming the health insurance industry by revolutionizing the way companies operate and deliver services. By leveraging AI technologies, health insurance companies have been able to streamline processes, enhance decision-making, and improve customer experiences.

Streamlining Claims Processing

AI is being used to automate claims processing, which can be a time-consuming and labor-intensive task. Through machine learning algorithms, AI can quickly analyze and validate claims, reducing the need for manual intervention and speeding up the overall process. This not only increases efficiency but also helps in detecting fraudulent claims more effectively.

Personalized Customer Experiences

AI tools are also being utilized to provide personalized customer experiences in health insurance. By analyzing customer data and behavior patterns, AI can offer tailored recommendations, suggest suitable insurance plans, and provide real-time support. This level of personalization enhances customer satisfaction and loyalty.

Enhanced Fraud Detection

One of the significant benefits of integrating AI in health insurance operations is the improved fraud detection capabilities. AI algorithms can analyze vast amounts of data to identify suspicious patterns or inconsistencies, flagging potential fraudulent activities early on. This proactive approach helps in minimizing losses and maintaining the integrity of the insurance system.

Efficient Resource Allocation

AI tools help health insurance companies in optimizing resource allocation by predicting future trends, analyzing data to identify areas of improvement, and automating routine tasks. This allows companies to allocate resources more efficiently, reduce costs, and enhance overall operational performance.

Real-time Data Analysis

AI enables health insurance companies to perform real-time data analysis, which is crucial for making informed decisions promptly. By processing data at a rapid pace, AI systems can identify trends, risks, and opportunities in real-time, allowing companies to respond swiftly to changing market conditions and customer needs.

Enhancing Customer Experience with AI

AI technologies play a crucial role in enhancing customer service within the health insurance industry. By leveraging AI tools, insurance companies can provide personalized interactions and tailored solutions to meet the needs of individual customers.

Personalized Customer Interactions

- Virtual Assistants: AI-powered chatbots and virtual assistants are used to provide real-time support to customers, answering queries, guiding them through the insurance process, and offering personalized recommendations.

- Behavioral Analytics: AI algorithms analyze customer behavior patterns to anticipate their needs and preferences, allowing insurance companies to tailor their communication and offerings accordingly.

- Personalized Recommendations: By analyzing customer data, AI can suggest specific insurance plans or coverage options that best suit an individual's lifestyle and health needs.

Analyzing Customer Data for Tailored Solutions

- Predictive Modeling: AI algorithms analyze vast amounts of customer data to predict future health risks or insurance needs, enabling companies to proactively offer relevant services or preventive measures.

- Risk Assessment: AI-powered systems evaluate individual risk profiles based on demographic, health, and lifestyle data, allowing insurers to create personalized insurance packages with appropriate coverage levels.

- Claims Processing: AI streamlines the claims process by quickly analyzing and verifying customer data, expediting claim approvals and ensuring a seamless experience for policyholders.

Fraud Detection and Prevention

AI plays a crucial role in detecting and preventing insurance fraud in the health insurance industry. By leveraging advanced algorithms and machine learning techniques, AI systems can analyze vast amounts of data to identify suspicious patterns and anomalies that may indicate fraudulent activities.

Role of AI in Fraud Detection

AI algorithms are used to flag potentially fraudulent health insurance claims by analyzing various data points such as medical records, billing information, and historical claim data. These algorithms can detect inconsistencies, duplicate claims, or unusual billing patterns that human investigators may overlook

- One example of AI algorithm used for fraud detection is anomaly detection, which can identify irregularities in claims data that deviate significantly from normal patterns.

- Another common algorithm is predictive modeling, where AI systems use historical data to predict the likelihood of a claim being fraudulent based on certain parameters.

- Natural Language Processing (NLP) algorithms are also employed to analyze text data in claims forms and medical records to detect any misleading information or discrepancies.

Impact of AI on Fraud Reduction

The implementation of AI in fraud detection has significantly reduced the number of fraudulent claims in the health insurance system. By automating the process of flagging suspicious activities, AI systems can help insurers prevent fraudulent claims before they are processed, thereby improving the overall integrity of the insurance system.

- According to a study by the Coalition Against Insurance Fraud, AI-powered fraud detection systems have led to a 25% decrease in fraudulent claims in the health insurance sector.

- By reducing fraudulent activities, AI not only saves insurers millions of dollars but also ensures that legitimate policyholders receive the benefits they are entitled to without disruptions.

- The continuous learning capabilities of AI systems also enable them to adapt to new fraud schemes and evolving tactics used by fraudsters, making them more effective in combating insurance fraud.

Data Analytics and Decision Making

AI plays a crucial role in data analytics within the health insurance industry. By utilizing advanced algorithms and machine learning techniques, AI can analyze vast amounts of data to extract valuable insights that can inform decision-making processes.

AI in Data Analytics

AI is used to process and analyze large volumes of health insurance data efficiently. Through machine learning algorithms, AI can identify patterns, trends, and correlations within the data that may not be immediately apparent to human analysts. This enables insurance companies to uncover valuable insights that can drive strategic decision-making.

- AI can help identify high-risk individuals or groups based on their health history, lifestyle choices, and other relevant factors. This allows insurers to tailor their offerings and pricing strategies accordingly.

- By analyzing claims data, AI can detect fraudulent activities and patterns, helping to prevent insurance fraud and minimize financial losses for both insurers and policyholders.

- AI-driven predictive modeling can assess risks more accurately by taking into account a wide range of variables and data points. This helps insurers set premiums that reflect the actual risk profile of each policyholder.

Final Conclusion

In conclusion, The Role of AI in Modernizing Health Insurance highlights the pivotal role that AI plays in shaping the future of health insurance. By leveraging AI technologies for data analytics, customer service enhancements, and fraud prevention, the industry is poised for significant advancements.

FAQ Resource

How is AI revolutionizing the health insurance industry?

AI is transforming the health insurance industry by streamlining processes, enhancing customer experiences, and improving fraud detection and prevention.

What are some examples of AI tools used in health insurance companies?

Some examples include chatbots for customer service, predictive analytics for risk assessment, and machine learning algorithms for fraud detection.

How does AI help in making informed decisions in health insurance?

AI aids in data analytics by providing insights for informed decision-making, such as setting insurance premiums based on predictive modeling and risk assessment.