Navigating the world of health insurance as a global remote worker can be daunting. Understanding the importance of having the right coverage and knowing how to choose the best plan is crucial for your well-being. Let's delve into essential tips and strategies to help you make informed decisions about your health insurance needs.

Importance of Health Insurance

Health insurance is a crucial component for global remote workers as it provides a safety net in times of medical emergencies, offering financial security and peace of mind.

Risks of Not Having Health Insurance

- Without health insurance, remote workers face the risk of incurring high medical costs that could potentially drain their savings or lead to debt.

- Not having coverage can limit access to quality healthcare services, especially in foreign countries where medical expenses can be significantly higher.

- In the absence of health insurance, remote workers may delay seeking necessary medical treatment, jeopardizing their health and well-being.

Financial Security in Medical Emergencies

- Health insurance provides a safety net by covering medical expenses for unexpected illnesses or injuries, reducing the financial burden on remote workers.

- Having health insurance ensures that remote workers can access timely medical care without worrying about the cost, allowing them to focus on recovery.

Variations in Health Insurance Coverage

The extent of health insurance coverage for remote workers can vary significantly depending on the country they reside in. For example:

| United States | In the US, health insurance is often tied to employment, making it challenging for independent remote workers to secure affordable coverage. |

| European Union | EU countries generally provide universal healthcare coverage, ensuring that remote workers have access to essential medical services. |

| Asia | Health insurance options in Asian countries can vary widely, with some offering comprehensive coverage while others may have limited benefits for remote workers. |

Types of Health Insurance Plans

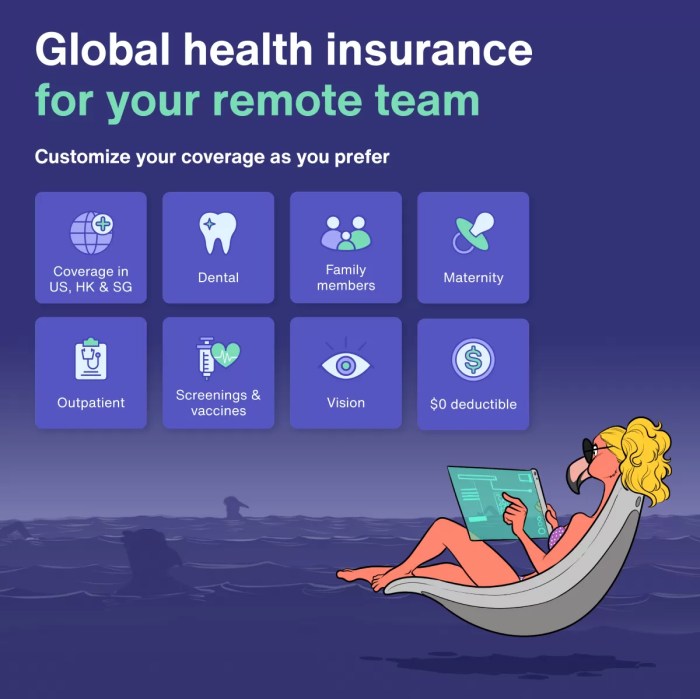

When it comes to health insurance for global remote workers, there are several types of plans to consider. Each type has its own features and benefits, so it's important to choose the right one based on your needs and circumstances.

International Health Insurance vs. Local Health Insurance

International health insurance plans are designed to provide coverage across multiple countries, making them ideal for remote workers who travel frequently or work in different locations. These plans offer a wide network of healthcare providers and typically include benefits such as emergency medical evacuation and repatriation.On the other hand, local health insurance plans are more limited in scope and coverage, as they are restricted to a specific country or region.

While these plans may be more affordable, they may not provide the same level of coverage or flexibility as international plans.

Key Features to Consider

When choosing a health insurance plan for remote work, it's important to consider key features such as coverage for routine and emergency medical care, access to a network of healthcare providers, coverage for pre-existing conditions, and flexibility to add or remove coverage as needed.

Additionally, it's crucial to review the policy's exclusions and limitations to ensure you understand what is and isn't covered.

Benefits of Comprehensive Coverage

Comprehensive health insurance coverage offers remote workers peace of mind knowing that they are protected in case of unexpected medical expenses or emergencies. With comprehensive coverage, remote workers can access quality healthcare services without worrying about the financial burden. Additionally, comprehensive plans often include benefits such as preventive care, wellness programs, and mental health services to support remote workers' overall well-being.

Coverage Considerations

Understanding the coverage limitations in health insurance plans is crucial for remote workers who are constantly on the move. It is essential to ensure that the policy provides adequate coverage for a wide range of medical services, including emergencies, routine check-ups, vaccinations, and preventive care

Importance of Coverage for Pre-existing Conditions

International health insurance plans should ideally cover pre-existing conditions, as these can significantly impact an individual's health. It is important for remote workers to disclose any pre-existing conditions when purchasing a policy to ensure they are adequately covered in case of medical emergencies related to these conditions.

Ensuring Adequate Coverage for Routine Check-ups and Preventive Care

To ensure adequate coverage for routine check-ups, vaccinations, and preventive care, remote workers should carefully review the benefits and coverage details of their health insurance plan. Opt for a policy that includes preventive care services without additional out-of-pocket costs, as these can help maintain overall health and catch potential health issues early on.

Common Coverage Considerations for Remote Workers

| Coverage Consideration | Explanation |

|---|---|

| Emergency Medical Care | Ensure coverage for emergency medical care in all countries of travel. |

| Telemedicine Services | Check if telemedicine services are included for remote consultations. |

| Mental Health Coverage | Verify coverage for mental health services, including therapy and counseling. |

| Prescription Drugs | See if prescription drug coverage is sufficient for regular medications. |

| Maternity Care | If applicable, ensure coverage for maternity care and childbirth expenses. |

Cost Management Strategies

As a global remote worker, managing health insurance costs is crucial to ensure financial stability and access to necessary healthcare. Understanding key concepts like co-payments, deductibles, and premiums can help in making informed decisions and optimizing expenses.

Negotiating Health Insurance Rates

When selecting a health insurance plan, consider negotiating rates with providers to secure the best deal. Discussing your specific needs and budget constraints can lead to customized options that align with your financial goals.

Finding Discounts for Remote Workers

- Research available discounts: Explore if there are any special discounts or offers for remote workers provided by insurance companies.

- Group policies: Joining group policies through professional organizations or affiliations can often result in discounted rates.

- Comparison shopping: Compare different insurance plans to identify cost-effective options that still meet your healthcare needs.

Comparison Table of Cost Management Strategies

| Strategy | Description |

|---|---|

| Negotiating Rates | Discussing and adjusting health insurance rates with providers to find the best fit for your budget. |

| Finding Discounts | Exploring various discount options and group policies to reduce overall insurance expenses. |

| Comparison Shopping | Comparing different insurance plans to select the most cost-effective option without sacrificing coverage. |

Outcome Summary

In conclusion, prioritizing your health insurance as a global remote worker is key to ensuring your peace of mind and financial security. By considering various factors like coverage options, cost management strategies, and coverage considerations, you can safeguard your health while pursuing your remote work lifestyle with confidence.

FAQ

What are the risks of not having health insurance as a global remote worker?

Without health insurance, remote workers face the financial burden of medical emergencies, which can potentially lead to high out-of-pocket costs and limited access to quality healthcare.

What key features should remote workers consider when choosing a health insurance plan?

Remote workers should look for plans that offer comprehensive coverage, including benefits for routine check-ups, emergency care, and coverage for pre-existing conditions. Additionally, considering coverage limitations and network providers is essential.

How can remote workers manage health insurance expenses effectively?

Cost-effective strategies include understanding co-payments, deductibles, and premiums, negotiating rates with insurance providers, and exploring discounts available for remote workers. By comparing different cost management strategies, remote workers can find the most suitable option for their needs.