Delving into the realm of Business Insurance Essentials Every Startup Must Know, this guide beckons readers with a wealth of valuable information, ensuring an enriching and informative reading experience.

Exploring the nuances of business insurance for startups, this guide aims to equip entrepreneurs with essential knowledge to navigate the complexities of insurance coverage.

Importance of Business Insurance

Business insurance is a crucial aspect for startups as it provides protection against various risks that could potentially harm the business. Having appropriate insurance coverage can help safeguard the assets and financial stability of a startup, ensuring its continuity and growth.

Examples of Potential Risks

- Property damage: Business insurance can cover the costs associated with damage to the physical assets of the startup, such as equipment, inventory, or office space, due to events like fires, theft, or natural disasters.

- Liability claims: If a startup is sued for negligence, personal injury, or copyright infringement, business insurance can help cover legal fees and settlements, protecting the company from financial loss.

- Business interruption: In the event of a disaster or unexpected event that halts operations, business insurance can provide coverage for lost income and ongoing expenses, allowing the startup to recover and resume business activities.

Protecting Startup’s Assets

By having the right insurance coverage in place, startups can protect their assets from unforeseen events that could otherwise lead to significant financial loss. Whether it's safeguarding physical property, mitigating liability risks, or ensuring business continuity, business insurance plays a vital role in securing the future of a startup.

Types of Business Insurance

When starting a new business, it is crucial to understand the different types of insurance available to protect your company from potential risks and liabilities. Here, we will identify and describe some of the key types of business insurance that every startup should consider.

General Liability Insurance

General liability insurance is essential for all businesses, as it provides coverage for claims of bodily injury, property damage, and advertising injury. This type of insurance helps protect your company from lawsuits and financial losses resulting from accidents or negligence.

Property Insurance

Property insurance covers damage to your business property, including buildings, equipment, inventory, and other assets. This insurance is important for startups with physical locations or valuable business property, as it helps replace or repair damaged items in the event of a covered loss.

Workers’ Compensation Insurance

Workers' compensation insurance is mandatory for most businesses with employees. This type of insurance provides benefits to employees who are injured or become ill while on the job. It helps cover medical expenses, lost wages, and other costs associated with work-related injuries.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is crucial for businesses that provide services or professional advice. This insurance protects against claims of negligence, errors, or omissions that result in financial harm to clients.

Business Interruption Insurance

Business interruption insurance helps cover lost income and expenses when your business is unable to operate due to a covered event, such as a natural disaster or fire. This insurance can help your startup recover and continue operating during challenging times.

Cyber Liability Insurance

Cyber liability insurance protects businesses from losses related to cyberattacks, data breaches, and other cyber threats. This type of insurance helps cover costs associated with investigating a breach, notifying affected parties, and recovering from a cyber incident.

Commercial Auto Insurance

Commercial auto insurance is essential for businesses that own vehicles used for work purposes. This insurance provides coverage for accidents, injuries, and property damage involving company vehicles. It is important for startups that rely on transportation for their operations

Product Liability Insurance

Product liability insurance protects businesses from claims related to injuries or damages caused by their products. This insurance is important for startups that manufacture or sell physical goods, as it helps cover legal expenses and compensation in the event of a product-related injury or lawsuit.

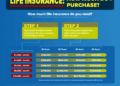

Determining Insurance Needs

Determining the appropriate insurance coverage for your startup is crucial to protect your business from potential risks and liabilities. Here is a step-by-step guide on how startups can assess their insurance needs and tailor their policies to best suit their specific industry and risks.

Assessing Coverage Amounts

- Start by identifying the potential risks and liabilities your startup faces. This can include property damage, liability claims, cyber attacks, or employee injuries.

- Calculate the value of your business assets, including equipment, inventory, and intellectual property, to determine the appropriate coverage amounts.

- Consider the potential costs associated with a worst-case scenario, such as a lawsuit or natural disaster, and ensure your coverage is sufficient to protect your business.

Tailoring Insurance Policies

- Research industry-specific insurance requirements and regulations to ensure your startup is compliant with necessary coverage.

- Consult with an insurance agent or broker who specializes in your industry to help you customize your policies to address your specific risks.

- Consider additional coverage options, such as business interruption insurance or professional liability insurance, to provide comprehensive protection for your startup.

Securing Affordable Insurance

Starting a business can be costly, but finding affordable insurance options is crucial for protecting your startup without breaking the bank.

Negotiating Insurance Premiums and Deductibles

- Research multiple insurance providers to compare quotes and coverage options.

- Consider bundling multiple types of insurance with the same provider for potential discounts.

- Ask about available discounts for implementing safety measures or having a good claims history.

- Discuss with your insurance agent ways to adjust your policy to lower premiums without sacrificing necessary coverage.

Leveraging Insurance Bundles or Packages

- Look for insurance companies that offer package deals for combining multiple types of coverage.

- Evaluate the specific needs of your startup and choose a bundle that provides adequate coverage at a lower cost.

- Consider the long-term savings of bundling insurance policies and adjust them as your business grows.

Final Review

In conclusion, understanding the importance of business insurance, the types available, determining specific needs, and securing affordable options are crucial steps for startups to thrive. By staying informed and proactive in managing insurance, startups can safeguard their assets and pave the way for long-term success.

User Queries

What are some common risks that business insurance can help mitigate?

Business insurance can help mitigate risks such as property damage, liability claims, employee injuries, and business interruptions.

How can startups determine the appropriate coverage amounts for their business?

Startups can determine coverage amounts by assessing their assets, potential risks, industry standards, and consulting with insurance professionals.

Are insurance bundles or packages a cost-effective option for startups?

Yes, insurance bundles or packages can be cost-effective for startups as they often offer discounted rates for combining multiple types of coverage.

![Annual Limits in Pet Insurance Explained [INFOGRAPHIC]](https://health.ayobandung.com/wp-content/uploads/2025/11/d29c3841722cf6f697f83fe20ab47e9c-75x75.jpg)