Exploring the realm of Top Life Insurance Options for Financial Security in 2025, this introduction sets the stage for a deep dive into the various insurance choices available. From term life to universal and variable options, we'll uncover the key aspects that can safeguard your financial future.

Let's begin by understanding the significance of life insurance and how it can provide a safety net in uncertain times.

Overview of Life Insurance Options

Life insurance plays a crucial role in providing financial security to individuals and their families in the event of unforeseen circumstances. It offers a safety net by ensuring that loved ones are protected and financially supported even after the policyholder's death.

When considering life insurance options, it is essential to understand the different types available and the key factors to consider in choosing the right policy.

Types of Life Insurance

- Term Life Insurance: Provides coverage for a specific period, typically 10, 20, or 30 years. It offers a death benefit to beneficiaries if the policyholder passes away during the term.

- Whole Life Insurance: Offers coverage for the entire lifetime of the policyholder. It includes a cash value component that grows over time and can be used for loans or withdrawals.

- Universal Life Insurance: Offers flexibility in premium payments and death benefits. It allows policyholders to adjust their coverage and premiums based on changing financial needs.

- Variable Life Insurance: Combines death benefits with investment options. Policyholders can allocate their premiums to different investment accounts, with the cash value dependent on the performance of these investments.

Key Factors to Consider

- Financial Goals: Determine the amount of coverage needed based on financial obligations, such as mortgage payments, education costs, and future expenses.

- Premium Affordability: Evaluate premium costs and ensure they align with your budget without compromising coverage.

- Policy Features: Understand the terms and conditions of the policy, including coverage limits, exclusions, and any additional benefits or riders.

- Insurance Company Reputation: Choose a reputable and financially stable insurance provider with a track record of timely claims processing and customer satisfaction.

- Estate Planning Needs: Consider how life insurance fits into your overall estate planning strategy, including tax implications and beneficiary designations.

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specified period, typically ranging from 10 to 30 years. If the insured individual passes away during the term of the policy, a death benefit is paid out to the beneficiaries.

If the insured individual outlives the term, no benefits are paid out.

Benefits of Term Life Insurance

- Cost-effective: Term life insurance tends to be more affordable compared to whole life or universal life insurance.

- Flexible coverage: Policyholders can choose the term length and coverage amount based on their needs and budget.

- Simple and straightforward: Term life insurance is easy to understand with no cash value or investment component.

Drawbacks of Term Life Insurance

- No cash value: Unlike permanent life insurance policies, term life insurance does not accumulate cash value over time.

- Premiums increase with age: As the insured individual gets older, premiums for term life insurance policies typically increase.

- No lifelong coverage: Term life insurance only provides coverage for a specific term, leaving individuals without coverage once the term ends.

Suitable Situations for Term Life Insurance

- Income protection: Term life insurance can help replace lost income for dependents in the event of the policyholder's death.

- Debt repayment: Individuals can use term life insurance to cover outstanding debts such as mortgages or loans.

- Temporary financial obligations: Term life insurance is ideal for covering financial responsibilities that will diminish over time, such as children's education expenses.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual, as long as premiums are paid. Unlike term life insurance, which offers coverage for a specific period, whole life insurance builds cash value over time and can also serve as an investment vehicle.

Advantages and Disadvantages of Whole Life Insurance

- Advantages:

- Provides lifelong coverage

- Builds cash value over time

- Guaranteed death benefit

- Can serve as an investment tool

- Disadvantages:

- Higher premiums compared to term life insurance

- Complex structure and fees

- May not offer the same returns as other investment options

- Less flexibility in adjusting coverage

How Whole Life Insurance Contributes to Long-Term Financial Security

Whole life insurance can play a crucial role in long-term financial security by providing a guaranteed death benefit to beneficiaries, ensuring financial protection for loved ones. Additionally, the cash value accumulation feature allows policyholders to access funds through policy loans or withdrawals, offering a financial cushion during emergencies or retirement.

The steady growth of cash value over time can also supplement retirement income or serve as a legacy for future generations, enhancing overall financial stability and security.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments and death benefits. Unlike term life insurance, which provides coverage for a specific period, and whole life insurance, which combines insurance with an investment component, universal life insurance allows policyholders to adjust their premiums and death benefits over time.

Features of Universal Life Insurance Policies

Universal life insurance policies typically offer the following features:

- Flexible premium payments

- Adjustable death benefits

- Cash value accumulation

- Ability to borrow against the cash value

How Universal Life Insurance Differs from Term and Whole Life Insurance

Universal life insurance differs from term life insurance in that it provides coverage for the policyholder's entire life, as long as premiums are paid. On the other hand, whole life insurance offers fixed premiums and a guaranteed death benefit, while universal life insurance allows for flexibility in premium payments and death benefits.

Scenarios Where Universal Life Insurance May be Beneficial

Universal life insurance may be beneficial in the following scenarios:

- For individuals who want flexibility in premium payments

- For those looking to adjust their death benefits as their financial needs change

- As a way to accumulate cash value over time for future financial needs

- For individuals who want the option to borrow against the cash value of their policy

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that offers a death benefit to beneficiaries upon the policyholder's passing. What sets variable life insurance apart is its investment component, allowing policyholders to allocate part of their premiums into various investment options, such as stocks, bonds, or mutual funds.

The cash value of the policy can fluctuate based on the performance of these investments, offering the potential for higher returns compared to traditional whole life insurance.

Investment Component of Variable Life Insurance

- Policyholders have the flexibility to choose how their premiums are invested, giving them the opportunity to potentially grow the cash value of their policy.

- The investment options within a variable life insurance policy are typically managed by professional fund managers, providing expertise in selecting and managing investments.

- The cash value of the policy can increase or decrease based on the performance of the chosen investments, offering the potential for higher returns but also exposing the policyholder to investment risks.

Risks Associated with Variable Life Insurance and Mitigation

- One of the main risks of variable life insurance is the volatility of the investment component, which can lead to fluctuations in the cash value of the policy.

- Policyholders need to carefully monitor and manage their investments to ensure they align with their risk tolerance and long-term financial goals.

- To mitigate risks, policyholders can diversify their investment allocations, regularly review their investment performance, and consult with financial advisors to make informed decisions.

Importance of Riders in Life Insurance

Life insurance riders are additional features that policyholders can add to their existing life insurance policies to customize and enhance coverage based on their specific needs. These riders provide flexibility and additional benefits beyond the standard coverage offered by the base policy.

Common Riders and Their Purposes

- Accidental Death Benefit Rider:This rider provides an additional payout if the insured's death is the result of an accident, offering financial protection for unexpected events.

- Waiver of Premium Rider:In the event of the insured becoming disabled or unable to work due to illness, this rider waives future premium payments, ensuring the policy remains in force.

- Term Conversion Rider:Allows the policyholder to convert a term life insurance policy into a permanent life insurance policy without the need for a medical exam, providing long-term coverage options.

Enhancing Coverage and Flexibility

- Riders can help policyholders tailor their life insurance coverage to meet changing needs over time, such as adding critical illness riders for additional financial protection against specific illnesses.

- By adding riders to a life insurance policy, individuals can customize their coverage without having to purchase multiple separate policies, making it a cost-effective way to enhance protection.

- These additional benefits ensure that policyholders have comprehensive coverage that aligns with their unique circumstances, offering peace of mind and financial security for themselves and their loved ones.

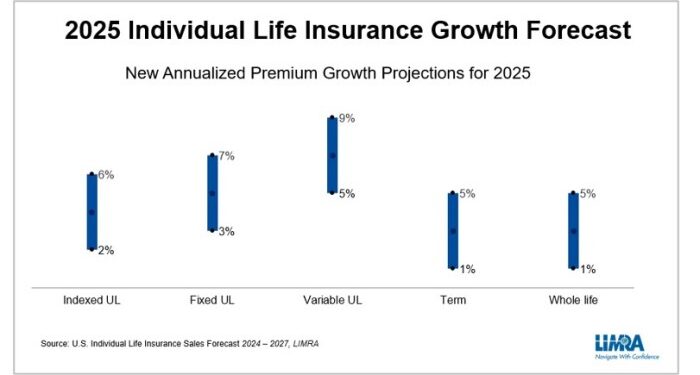

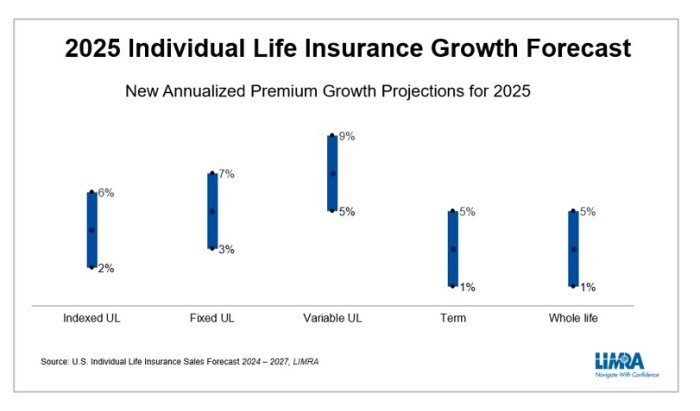

Trends and Innovations in Life Insurance

Life insurance is an ever-evolving industry that constantly adapts to changing consumer needs, technological advancements, and regulatory requirements. In 2025, several emerging trends and innovations are shaping the landscape of life insurance, influencing the development of new products and services.

Use of Artificial Intelligence in Underwriting

Artificial intelligence (AI) is revolutionizing the underwriting process in life insurance. Insurers are leveraging AI algorithms to analyze vast amounts of data quickly and accurately assess risk profiles. This technology enables insurers to offer more personalized policies based on individual health and lifestyle factors, leading to more efficient underwriting processes and better pricing for consumers.

Integration of Wearable Technology

The integration of wearable technology devices, such as fitness trackers and smartwatches, is becoming increasingly common in the life insurance industry. Insurers are partnering with tech companies to collect real-time health data from policyholders, promoting healthier lifestyles and incentivizing customers with discounts or rewards for maintaining active habits.

This trend not only benefits policyholders by encouraging healthier living but also allows insurers to better understand and manage risks.

Expansion of Digital Distribution Channels

The digital transformation of the insurance industry is accelerating, with a growing emphasis on digital distribution channels for life insurance products. Insurers are investing in user-friendly online platforms and mobile apps to provide customers with easy access to information, quotes, and policy management tools.

This shift towards digital channels not only enhances customer experience but also enables insurers to reach a broader audience and streamline the purchasing process.

Focus on ESG Investing

Environmental, social, and governance (ESG) factors are gaining prominence in the investment strategies of life insurance companies. Insurers are increasingly incorporating ESG criteria into their investment decisions, aligning their portfolios with sustainable and socially responsible practices. By prioritizing ESG investing, insurers are not only contributing to positive societal and environmental outcomes but also mitigating long-term risks and enhancing financial performance.

Regulatory Emphasis on Consumer Protection

Regulatory bodies are placing a greater emphasis on consumer protection and transparency in the life insurance sector. Stricter regulations and guidelines are being implemented to ensure that insurers act in the best interests of policyholders, disclose information clearly, and provide fair treatment to customers.

These regulatory changes aim to enhance trust in the insurance industry, safeguard consumer rights, and promote a more ethical and accountable approach to insurance practices.

Conclusion

As we conclude our discussion on Top Life Insurance Options for Financial Security in 2025, it's clear that making an informed choice can pave the way for a secure tomorrow. By weighing the pros and cons of different policies and considering your unique needs, you can embark on a path towards financial peace of mind.

Common Queries

What are the key factors to consider when choosing a life insurance policy?

Factors to consider include your financial goals, budget, age, health, and long-term needs.

How does whole life insurance differ from term life insurance?

Whole life insurance provides coverage for your entire life, while term life insurance covers a specific term.

What are some common riders available in life insurance policies?

Common riders include critical illness, accidental death, and waiver of premium.

How are technological advancements shaping life insurance products for 2025?

Technology is enhancing policy management, underwriting processes, and customer experience in the life insurance sector.