Starting off with Renters Insurance 101: Everything You Need in 2025, this introductory paragraph aims to draw in the readers with a compelling overview of the topic.

The following paragraph will delve deeper into the specifics and details of the subject matter.

Understanding Renters Insurance

Renters insurance is a type of insurance policy designed to protect tenants from financial losses due to events such as theft, fire, or liability claims. It provides coverage for personal belongings, liability protection, and additional living expenses in case the rental becomes uninhabitable.

Importance of Renters Insurance

Renters insurance is crucial for tenants as it offers financial protection in case of unforeseen events like theft, fire, or natural disasters. Without renters insurance, tenants may face significant financial burdens to replace belongings or cover liability claims.

Common Coverage Areas in Renters Insurance

- Personal Property: Covers the cost of replacing personal belongings like furniture, electronics, and clothing.

- Liability Protection: Protects tenants from legal claims and lawsuits if someone is injured in their rental unit.

- Additional Living Expenses: Covers the cost of temporary housing and living expenses if the rental becomes uninhabitable.

How Renters Insurance Differs from Homeowners Insurance

Renters insurance is specifically designed for tenants renting a property, while homeowners insurance is for homeowners who own the property they live in. Homeowners insurance typically includes coverage for the structure of the home, while renters insurance focuses on personal belongings and liability protection within the rental unit.

Benefits of Renters Insurance

Renters insurance offers a range of benefits that can provide financial protection and peace of mind for tenants. From safeguarding personal belongings to covering liability costs, renters insurance is a valuable investment for renters. Let's explore the key benefits in more detail.

Protecting Personal Belongings

- Personal Property Coverage: Renters insurance can help replace or repair personal belongings, such as furniture, electronics, and clothing, in the event of covered perils like fire, theft, or vandalism.

- Off-Premises Coverage: This extends coverage to belongings outside the rental property, such as items stolen from your car or while traveling.

- Valuable Items Coverage: Special coverage can be added for high-value items like jewelry, artwork, or electronics that may exceed standard policy limits.

Liability Coverage

- Personal Liability Protection: Renters insurance can help cover legal expenses and medical bills if someone is injured on your rental property and you are found liable.

- Property Damage Liability: This coverage can help pay for damages you accidentally cause to someone else's property, such as water damage from an overflowing bathtub.

- No-Fault Medical Coverage: If a guest is injured in your rental unit, renters insurance can help cover their medical expenses regardless of fault.

Additional Living Expenses Coverage

- Loss of Use Coverage: If your rental unit becomes uninhabitable due to a covered peril, renters insurance can help cover additional living expenses, such as hotel stays or temporary rentals, while repairs are being made.

- Food and Storage Costs: This coverage can also reimburse you for increased food expenses and storage costs incurred during the displacement from your rental property.

Factors to Consider When Choosing Renters Insurance

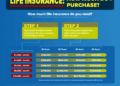

When selecting renters insurance, it is crucial to consider various factors to ensure you have the right coverage to protect your belongings and liabilities. Here are some key points to keep in mind:

Checklist for Evaluating Renters Insurance Policies

- Review the coverage options offered by different insurance companies.

- Compare premiums and deductibles to find a policy that fits your budget.

- Check the limits for personal property coverage and liability protection.

- Look for additional coverage options like loss of use or medical payments.

Comparison of Coverage Options

- Actual Cash Value (ACV) vs. Replacement Cost Coverage: ACV pays for the current value of your belongings, while replacement cost coverage reimburses you for the cost of replacing items at today's prices.

- Liability Coverage: Consider the amount of liability protection offered in case someone is injured in your rental unit.

Determining Appropriate Coverage Limits

- Take inventory of your belongings to estimate the value of your personal property.

- Consider the value of high-ticket items like electronics, jewelry, or furniture when setting coverage limits.

Significance of Deductibles

- Choose a deductible that you can comfortably afford in case you need to file a claim.

- Higher deductibles typically result in lower premiums, but be sure you can cover the out-of-pocket costs when needed.

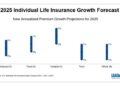

Renters Insurance Trends in 2025

The landscape of renters insurance is constantly evolving, influenced by various factors such as emerging technologies, changes in pricing, climate change impacts, and industry practices. Let's delve into some of the key trends shaping renters insurance in 2025.

Emerging Technologies Impacting Renters Insurance

In 2025, the renters insurance industry is expected to leverage cutting-edge technologies such as artificial intelligence, Internet of Things (IoT), and big data analytics to streamline processes, enhance customer experience, and mitigate risks. Insurers may use AI algorithms to assess claims faster, IoT devices to prevent losses, and big data to personalize policies based on individual needs.

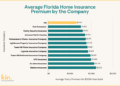

Changes in Pricing and Affordability of Renters Insurance

With advancements in data analytics and risk assessment tools, renters insurance pricing is becoming more personalized and tailored to individual circumstances. In 2025, renters may benefit from more competitive pricing based on their specific risk profiles, driving affordability and accessibility in the market.

Impact of Climate Change on Renters Insurance Coverage

As climate change continues to pose significant challenges, renters insurance coverage may evolve to address related risks such as extreme weather events, flooding, and wildfires. Insurers may adjust policy terms, coverage limits, and pricing models to reflect the changing climate landscape and ensure adequate protection for renters in high-risk areas.

Future Developments in Renters Insurance Industry Practices

Looking ahead to 2025, the renters insurance industry is poised for transformative changes in customer engagement, claims processing, and product innovation. Insurers may adopt more digital-friendly approaches, enhance transparency in policy offerings, and introduce innovative coverage options to meet the evolving needs of renters in a dynamic market environment.

Wrap-Up

Concluding with a captivating summary, this paragraph wraps up the discussion on Renters Insurance 101: Everything You Need in 2025, leaving readers with a lasting impression.

Essential FAQs

What does renters insurance cover?

Renters insurance typically covers personal belongings, liability protection, and additional living expenses in case of unexpected events like theft or fire.

How do I determine the appropriate coverage limits for renters insurance?

To determine the right coverage limits, assess the value of your belongings and consider potential liability risks, ensuring you have adequate protection.

What are some emerging technologies impacting renters insurance in 2025?

In 2025, technologies like AI and IoT are likely to play a significant role in improving risk assessment and claims processing in the renters insurance industry.